Backstory

Transforming the Custodial Space for the Digital Age

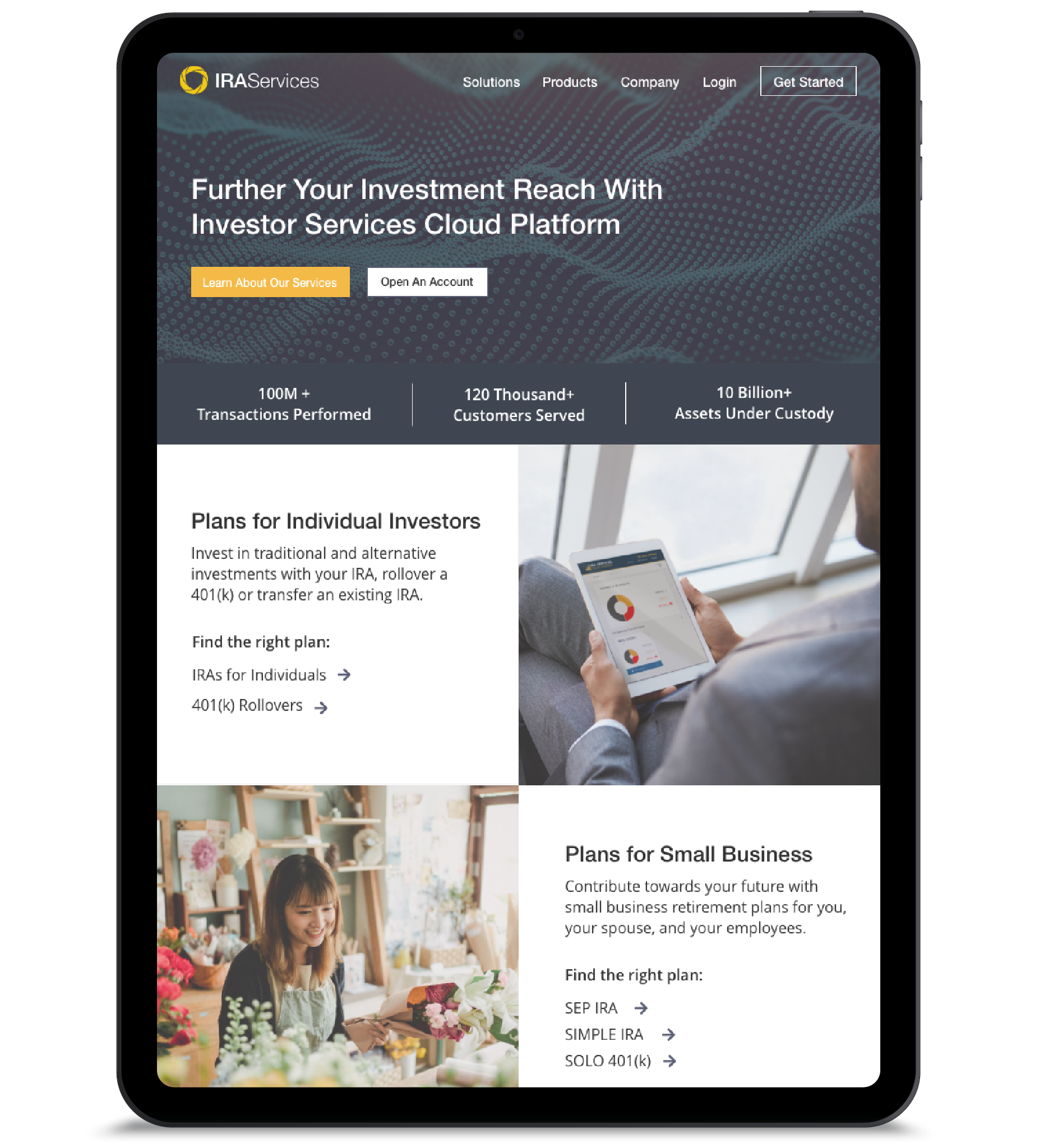

Our client, a custodial trust company based in California, specializes in managing non-exchange traded investments such as real estate and private equity. The company oversees complex, self-directed accounts that still rely on outdated paper processes.

With a clear objective to modernize, the client sought to reduce complexity while providing a user-friendly digital interface with 24/7 account access for its customers.

Key Insight

Integrating Process & Technology

Although the custodial process had traditionally been paper-based, the client sought to leverage technology to streamline key operations, such as account creation and investment transactions. The platform was designed to not only support internal processes but also integrate with essential business tools, creating a seamless experience for both the company and its clients.

Strategy & Approach

Comprehensive Research, Design, and Development

We worked closely with a cross-functional team of software architects to define a robust digital strategy, enabling the platform to offer a diverse set of investment capabilities.

- User-Friendly Interface: We designed an intuitive interface to facilitate account creation and management for customers.

- Scalable Web Applications: We developed mobile-friendly, scalable web applications that enable account management, resource exploration, and compliance tracking.

- Seamless Investing Experience: Our goal was to provide a seamless, digital investing experience tailored for modern self-directed investments.

Throughout the process, our multi-faceted strategy covered the following:

- Digital strategy

- Front-end web app design and development

- Digital & Print Advertising

- Communications, messaging, and product launch

- Event spaces

- Business development initiatives

Key Insight

Enabling Growth at Scale

The platform’s scalability allowed institutional clients to white-label merchant transactions, effectively extending business services to their partners and customers.

Unifying the brandOutcome

Revolutionizing Self-Directed Investments

After nearly two years of collaboration, we successfully initiated over $11 billion in assets under custody. Following this achievement, the company underwent an evaluation and was subsequently acquired.

new accounts

+140k

we reach markets